Update: New York Community Bank

- Mar 26, 2023

- 10 min read

March 20, 2023 | Premium Service | As the Fed-induced banking crisis in the US rolls into another week, markets and investors are already starting to pick winners and losers. As we’ve noted earlier, the past several decades of steadily declining interest rates allowed a number of niche business models to bloom and even prosper, both in banking and nonbank finance. Now that process is being reversed as the Fed bumbles the post-QE adjustment process.

Less stable bank business models are under attack by a 4% yield on Treasury bills and concerns about bank asset quality. Reserves at the Fed are being paid almost 5% this AM, an act of idiocy that suggests every member of the FOMC ought to be impeached immediately. The indifference and insensitivity shown by the FOMC with respect to the banking sector and the bond market reveals a level of incompetence that borders on the criminal. Interest expense/average assets for all large US banks at year-end 2022, of note, was a smidge over 1%. What else need be said?

Source: Federal Reserve Board

For marginal banks, the trouble starts on the asset side of the balance sheet due to unrealized losses on securities and also loans. Then the trouble quickly migrates to the liability side, when large depositors depart in favor or T-bills. Sure, Silicon Valley Bank committed ritual suicide by buying too many mortgage-backed securities, but have no doubt that 4% T-bill and similar yields on reserves deposited at the Federal Reserve Bank are a primary source of deposit runs on small banks.

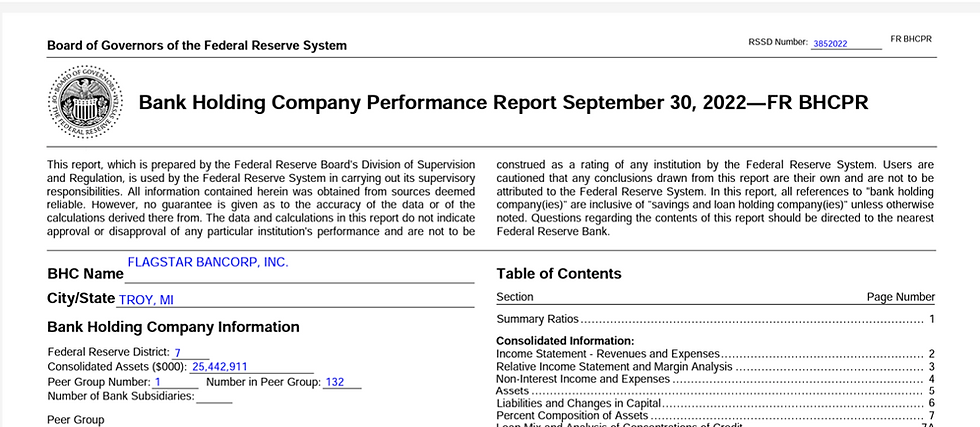

One bank that we believe will weather the storm created by the Federal Open Market Committee is New York Community Bank (NYCB), which acquired Flagstar Bancorp (FBC) on December 1, 2022. We previously profiled the combination of NYCB and FBC in May 2021 (“Profile: NYCB + Flagstar Bancorp”), but due to progressive yowling and political extortion in Washington, the merger was delayed over a year. Below we update that profile and reflect on how the acquisition of assets from the failed Signature Bank will make this $90 billion asset lender even more interesting.

Because the NYCB + FBC combination only closed on December 1st of last year, there is limited information available. NYCB provided pro-forma financials in their year-end earnings release. The Form 10-filed by NYCB on March 1, 2023, includes the balance sheet and income statements for the two banks. We also now have available the consolidated Bank Holding Company Performance Report from the FFIEC for 12/31/22 to facilitate our analysis. We encourage subscribers to our Premium Service to review the May 2021 profile as a background for this comment.

The merged NYCB has several interesting attributes, but above-peer credit performance is perhaps the most important. As we noted in 2021:

“NYCB has consistently ranked among the bottom 10% of large banks in terms of credit losses, in some cases reporting zero or negative loss given default (LGD). As a result, the load on earnings from loan loss provisions is very low, in the bottom 5% of the 128 large banks included in Peer Group 1. Again, on a risk adjusted basis, the equity returns for NYCB seem to be better than its asset peers and its performance displays less variability.”

Likewise, FBC historically displayed loss rates below its peers even as it has grown into the second largest mortgage warehouse lender in the US after JPMorgan (JPM). We interviewed Flagstar mortgage head Lee Smith in August of 2021. Unknown to most investors, FBC is one of the largest servicers of residential loans in the US, but primarily as a sub-servicer. FBC ranks 26th in the US in terms of its owned servicing assets, according to Inside Mortgage Finance, yet it ranks sixth in terms of overall loans serviced with $265 billion in assets under management (AUM) at year-end 2022.

To understand the value proposition of FBC, they have focused on the higher return aspects of the mortgage ecosystem, while shedding the more problematic areas of risk in the residential market and especially Ginnie Mae mortgage servicing exposures. FBC services loans for a fee, lends money on a fully secured basis to other bank and nonbank lenders to finance production, issues its own MBS and provides high-touch default servicing on the same platform using some of the best partners in the industry.

FBC is reckoned to be one of the better bank servicers of FHA/VA/USDA loans, yet FBC has deliberately sold its Ginnie Mae MSR to other parties. Fact is, you can lose more than your initial investment on a Ginnie Mae MSR. Like other banks, FBC made the obvious decision and sold these MSRs to more optimistic investors. Even as it shed exposures to Ginnie Mae, however, FBC retained the sub-servicing business and, most important, control over the escrow balances.

If a loan Flagstar services on behalf of an investor or correspondent happens to slide into distress, FBC already has that loan on its platform, with the customer support, financing and other services necessary for effective loss mitigation immediately available. As the US mortgage market heads into a period of higher credit losses, we believe that FBC will be nicely positioned to address this market need and grow earnings accordingly. But it is important to emphasize that 1-4 family loans represent only a single-digit slice of NYCB’s owned portfolio. The combination of FBC with NYCB creates an overall servicing portfolio that is still predominantly comprised of commercial and multifamily loans, as shown in the chart below.

Source: NYCB

Looking that the most recent report from the FFIEC, we have month’s income for FBC, but the full balance sheet and capital accounts for the consolidated bank. The last form 10 filed with the SEC and form Y-9 filed with the Fed was Q3 2022.

In terms of key metrics for NYCB and FBC, below are several charts we can use to compared the performance of the two banks and how they stack up against the 131 largest US bank holding companies in Peer Group 1. The Peer Group 1 numbers are simple unweighted averages that exclude unitary banks but do include our two subjects.

First, we look at net losses/average assets for the two lenders. You can clearly see NYCB tracking well-below peer in terms of net loss rates, but FBC is above peer and shows far more motion in terms of the rate of change quarter-to-quarter. Recall that in 2020-2021, loan payment moratoria were in effect and millions of American families had sought forbearance on loans and leases. In 2022, when foreclosure activity resumed, many banks and nonbanks saw sharp upward spikes in delinquency.

Source: FFIEC

After credit, the next metric to consider is the pricing on the bank’s loan book, a key indicator of profitability and management. As shown in the chart below, FBC tended to track Peer Group 1 in terms of gross loan spread, before funding costs and SG&A expenses, while NYCB historically has reported below-peer loan spreads. As we shall discuss below, these results for NYCB are mitigated by the low credit expenses and superior operating efficiency.

Source: FFIEC

The next area to consider in our analysis is funding costs and again NYCB shows above peer funding expenses compared to FBC and other large banks. Part of the reason for this is that the bank historically had a high reliance on non-core funding costs, comprising more that 1/3 of total funding. The reason for this above-peer reliance on non-core funding has to do with the fact that NYCB has far better utilization of its balance sheet than most banks.

Net loans and leases at NYCB equaled over 77% of total assets at year-end 2022 vs just 63% for Peer Group 1, including the balance sheet footings of FBC. While many banks have been content to buy securities during the period of QE and take the attendant market risk, NYCB took a different approach historically, minimizing securities holdings and maximizing lending. NYCB carries just half of the liquid securities investments of the Peer Group 1 average of 22% and, importantly, keeps all of its securities in available-for-sale.

More, the bank has maintained 3:1 ratio between short-term assets and short-term liabilities going back five years. As a result, the bank’s accumulated other comprehensive income (AOCI) in Q4 2022 was just -$600 million vs $8.3 billion in Tier 1 capital. By avoiding securities investments and marking its securities to market every day, NYCB minimized the market risk that now plagues many other banks. And now with the close of the purchase of FBC in the Q4 2022 and the purchase and assumption from Signature Bank in Q1 2023, the funding profile for NYCB is improving dramatically.

The chart below shows the net income/average assets for NYCB, FBC and Peer Group 1. Notice that FBC shows more variability than NYCB, which has tended to track Peer Group 1 closely. FBC shows the variability of the wholesale lending and securitization business, which is closely tied to interest rates, while NYCB displays far less variability. Since the NYCB income numbers only include one month of FBC results, the full impact of the non-interest income of the Flagstar business is not apparent. In Q3 2022, FBC’s non-interest income was over 5% of total assets vs less than 1% for the average of Peer Group 1, a powerful new income stream for NYCB.

Source: FFIEC

While the analysis so far is mixed in terms of the overall view of NYCB, it is only when you compare the bank’s operating overhead to other banks that you start to understand the significant advantage that NYCB has over many other banks. Although FBC has tended to have high operating expenses because of the variability of the wholesale side of the business, NYCB’s operating expenses, including one month of FBC results, were in the bottom 3% of Peer Group 1 or just 1.09% of average assets.

In Q4 2022, NYCB’s efficiency ratio (Overhead expenses / Net Interest Income + non-interest income) was 42.3% or 15 points below the average for the 131 banks in Peer Group 1. FBC had an efficiency ratio in the 80s in Q3 2022, largely because of the sharp drop in mortgage lending and MBS issuance in the residential and commercial markets. This led NYCB to take the decision to shut-down all of FBC’s loan production offices nationwide in Q4 and to shrink the bank’s footprint in correspondent lending. The chart below shows the efficiency ratio for NYCB, FBC and Peer Group 1.

Source: FFIEC

Even with the inclusion of one quarter of the results of FBC, NYCB remains in the low 40s in terms of operating efficiency vs the average for Peer Group 1 in the high 50s. More, as discussed below, the addition of the assets and liabilities from Signature Banks is now going to allow the post-FBC merger NYCB to de-lever its balance sheet and pay-down some of those non-core deposits mentioned above, leading to a stronger and more flexible banking franchise.

Signature Bank

It is important for readers of The Institutional Risk Analyst to understand that when you buy assets from the Federal Deposit Insurance Corp acting as Receiver of a failed bank, the initial cost basis of the assets is zero. NYCB acquired a highly liquid, mostly cash balance sheet from the FDIC with a $2.725 billion excess asset position at no deposit premium. This included $34 billion in deposits (all deposits other than deposits related to crypto currencies) and significant noninterest bearing deposits assumed. NYCB purchased $18 billion in loans and received a total of $34 billion in cash in the transaction.

NYCB has stated in its press release following the announcement of the FDIC deal that it will use this excess liquidity to pay down a substantial amount of wholesale borrowings, leaving the balance sheet with a strong liquidity position. FDIC received an equity stake valued at $300 million in NYCB as consideration to offset the cost of the takeover of Signature Bank. The table below summarizes the transaction with the FDIC. Notice again that the net assets of the transaction (assets-liabilities) is just $2.7 billion for $38 billion in assets.

Source: NYCB

Of note, NYCB is not acquiring the remaining loan portfolios (includes fund banking, CRE, or multifamily) from Signature, QFCs or the credit card business. Nor is NYCB acquiring crypto related deposits and Signet. The transaction with the FDIC adds new branches on both coasts in NY, CA, CT, NC and NV and new business verticals to drive revenue in the future.

As a result of the FDIC transaction, NYCB’s core deposits increase from $59 billion to $93 billion, including a significant amount of noninterest bearing deposits. NYCB receives $25 billion of cash from FDIC to pay down wholesale borrowings, which lowers loan to deposit ratio from 118% to 88%. This transaction should be immediately accretive to NYCB shareholders, including a 20% increase in terms of earnings per share and a 15% increase in tangible book value estimated by NYCB due to the discount structure of the transaction.

We liked the NYCB + Flagstar story prior to the transaction with the FDIC for the assets of Signature Bank. We like the story even more now. We believe that the asset purchase and deposit assumption transaction with the FDIC transforms NYCB from an interesting story into a compelling opportunity. Assuming that the Fed does not destroy the US economy in the next few weeks, we intend to add NYCB to our portfolio.

Disclosures

L: CS, CVX, NVDA, WMB, JPM.PRK, BAC.PRA, USB.PRM, WFC.PRZ, WFC.PRQ, CPRN, WPL.CF, NOVC, LDI, WAL, GHLD

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes only and is not intended for trading purposes or financial advice. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

.png)

Comments