Source: FDIC

Summary & Outlook

In this issue of The IRA Bank Book Q3 2020, we survey a banking market that has been disrupted by the onset of COVID and the subsequent response from the Federal Reserve, Treasury and civil authorities. The bank data from Q2 is in some cases skewed by these events, in other cases seemingly normal. Below the surface there is considerable change and opportunity.

One thing to count as highly likely is that losses from the global business shock from COVID will exceed actual bank losses in 2009. Deposits held by FDIC insured banks rose by more than $1 trillion in Q2 2020 after a similar increase in Q1, but net interest margin dropped for the third quarter in a row. Overall, banking industry operating income is trending down from the peaks of 2019.

“Quarterly net income for the 5,066 FDIC-insured commercial banks and savings institutions totaled $18.8 billion during second quarter 2020,” the bank insurance agency reported, “a decline of $43.7 billion (70 percent) from a year ago.” The chart below shows the deterioration of bank net interest income.

Source: FDIC

In Q3 2020, spreads on loan products have become tighter and volumes have fallen, part of a larger global shortage of collateral engineered by the Fed and other central banks. One of the key indicators that has emerged since September of 2019 has been a sharp reduction in loan sales by banks, which have presumably chosen to retain their production in portfolio.

As the table below suggests, sales of auto loans and C&I credits have essentially gone to zero while sales of 1-4 family mortgages have likewise fallen – this even as mortgage industry production volumes have generally risen by 30-40% in 2020. Auto loan sales by banks likewise are running at 10% of 2016 levels. Of note, the brief increase in bank assets serviced for others (ASO) above $6 trillion has been reversed in the past two quarters.

Source: FDIC

As bank share of mortgage production has declined, the lion’s share of the increase in volume is being captured by the stronger nonbank issuers such as Rocket Mortgage (NYSE:RKT), Mr. Cooper (NYSE:COOP) and Freedom Financial. The plat de jour is Ginne Mae or course. In the past several weeks, we have seen JPM’s Chase unit as a seller of seasoned 1-4s in a recent non-agency MBS deal, capturing a rich gain-on-sale opportunity.

Even as income growth has moderated and now turned negative, credit costs rose again sharply in Q2 2020 to over $60 billion in provisions put aside for future loss. We anticipate that provisions could remain at these elevated levels for the balance of the year or longer. This implies that industry operating income is likely to go into the red in Q3 and especially Q4, when we anticipate a significant credit loss event comparable to the end of 2009. The chart below shows actual operating income vs provisions for the US banking industry though Q2 2020.

Source: FDIC

Of note, the FDIC reports that banks which employed the current expected credit loss (CECL) methodology saw higher provisions than did banks not yet using CECL. They report: “During the second quarter, 253 banks used the CECL accounting standard. CECL adopters reported $56.3 billion in provisions for credit losses in second quarter, up 419.2 percent from a year ago, and non-CECL adopters reported $5.6 billion, up 207.3 percent. Almost two out of every three banks (61.2 percent) reported yearly increases in provision for credit losses.”

Needless to say, asset and equity returns for the industry have declined significantly, with ROA below 40bp and ROE sub-4%. Compared with the 12% equity returns averaged by the industry in 2019, the results post-COVID-19 are truly dreadful and likely to get worse in the near term. The stock market may experience a “V” shaped recovery, but the real commercial economy of people and businesses is not so fortunate.

The fact of weakening earnings will not prevent managers from owning the large cap names such as JPMorgan (NYSE:JPM), American Express (NYSE:AXP) and U.S. Bancorp (NYSE:USB) and at significant premiums to book value. Even The Goldman Sachs Group (NYSE:GS) managed in the closing days of August to crawl up to a mere 10% discount to book value, as sure a sign as could be found that asset price inflation is now a serious problem.

Credit Analysis & Charts

The key takeaway from the Q2 2020 bank results is that credit conditions are changing and for the worse. Street earnings estimates for top-10 banks are retreating as you might expect. The large provision expense that curtailed bank income in Q1 and Q2 is now being met with actual credit losses and rising loss rates given default (LGD) on some key loan classes in Q3 2020.

The good news is that credit indicators on residential mortgage exposures remain strong from an investor perspective. Negative LGDs underline a credit market environment where collateral values below the conforming limit continue to rise, perhaps in an unsustainable fashion. But such warnings have been heard for some years now and run contrary to the stated policy of the FOMC with respect to inflation targeting. Even valuations for once moribund jumbo residential properties have been buoyed by the panic out-migration from the major cities such as New York and Los Angeles.

Outside of the world of residential credit, however, the outlook is decidedly bearish in terms of the probability of higher defaults and the likely value of collateral going forward. From a big picture perspective, LGD for all bank loans trended down since 2011 and then went roughly flatline through 2017. But since 2018, loss given default has been moving higher, long before the liquidity problems of 2019 or COVID in 2020. We anticipate that this trend of rising LGD will now accelerate and driven by COVID and the collateral damage emanating from the pandemic.

Total Loans & Leases

In the chart below we show loss given default or LGD for the $11 trillion in total loans held in portfolio by US banks. This measure was developed a decade ago by Institutional Risk Analytics based upon the early days of Basle I. LGD reflects the loss per dollar of actual value charged off, which is a reflection of the market for the collateral underneath the asset.

Source: FDIC/WGA LLC

We expect to see loss given default for all loans rise toward 90% and even above in the next several quarters. Indeed, as you’ll note below, the Commercial & Industrial portfolio has already hit 90% loss as we predicted earlier and will lead other asset classes higher in coming months.

The US faces a commercial credit crisis in 2020 vs a residential mortgage liquidity event in 2008. At the same time, default rates and delinquency have been trending gently higher in commercial credits since 2018. With the onset of the COVID pandemic, we now see early indications that loan delinquency is rising rapidly across the broad portfolio of FDIC-insured banks.

As the chart below suggests, the amount of provision expense measured by non-current loans is far higher than the actual cash losses realized.

Source: FDIC

Total Real Estate Loans

Despite the relative strength of the residential sector, the COVID-related problems in commercial and other areas of the bank real estate portfolio are starting to show up in the reporting. While the weight of the COVID pandemic is being felt most acutely in the commercial sector, we think residential defaults could become an issue in 2022 or thereafter. At present, from a creditor perspective, the strong collateral values in 1-4s are a big positive.

Source: FDIC

Note that actual credit losses in real estate loans generally remain negligible, at least for now. Indeed, the increase in non-current loan balances reflects delinquent 1-4 family Ginnie Mae (GNMA) loans, which are guaranteed by the U.S. government. These loans have been subject to early buyouts (EBOs) by the likes of JPM and Wells Fargo (NYSE:WFC), thus inflating loan delinquency stats. Many of these EBOs will, in fact, reperform or be modified short of forclosure.

Source: FDIC

Given the relatively high rates of delinquency in the GNMA market and the dearth of zero-risk assets with carry available to banks, we look for EBOs to increase. For large, GNMA seller/servicers such as WFC, EBOs of FHA/VA/USDA covered loans is an attractive way to accumulate risk free assets with a significant spread. And as we've noted in National Mortgage News, WFC and other banks may actually retain these loans in portfolio to retain the servicing indefinitely.

In a harbinger of things to come in commercial real estate, the observed loss given default for all $5 trillion of real estate loans actually surged in Q2 2020, as shown in the chart below. This suggests some softness ahead in collateral values in the non-residential sector.

Source: FDIC/WGA LLC

1-4 Family Loans

Of the $2.5 trillion in 1-4 family loans owned by banks, a larger percentage are now shown as delinquent, mostly due to the increase in GNMA EBOs as mentioned above. Non-current rates rose 40bp to 2.07% in Q2 2020 and we expect to see that series closer to 5% by year end. All that said, 1-4s are likely to remain the best credit sector overall in terms of bank owned loans.

Source: FDIC

Of interest, the move in LGD for 1-4 family loans owned by banks is far more muted than the move in total real estate loans. Notice that LGDs in 1-4s remain negative, reflecting a net positive outcome upon default for the portfolio. The volume of defaults and recoveries also remain low by historical standards.

Source: FDIC/WGA LLC

Again, the demand for existing homes below the conforming limit in most markets remains robust and thus the LGD is negative. Because of the disruption in the jumbo loan market, financing is qualified for larger, millions plus loans, yet LGD remains negative on average at the portfolio level. The average LGD for bank owned 1-4s back to 1990 is 69%, of interest. The table below shows delinquency rates for all 1-4s. H/T to Joe Garrett.

1-4 Family Loan Delinquency

Source: MBA, FDIC

The world of bigger loans above the conforming limit is largely a bank and hard money market today, but there are hopes of a recovery in areas such as single family rentals and jumbos loans for broader distribution. Correspondent and other channels remain largely closed for now. We see any recovery in volumes as likely a Q1 2021 conversation based upon current market flows visible today.

Multifamily Loans

In the world of multifamily loans, the battle in terms of realized losses swung sharply positive as LGD rose to nearly 50% after being negative about as much the previous quarter. The volatility in portfolio level loss rates for the half trillion in bank-owned multifamily assets is hard to decipher, but suffice to say we see LGD moving higher for this asset class in Q3 2020 and beyond.

Source: FDIC/WGA LLC

Source: FDIC

Home Equity Lines of Credit

In terms of home equity lines of credit or HELOCs, the asset class continues to dwindle under the relentless onslaught of lower interest rates. Between Q2 of 2019 and Q2 2020, the outstanding principal balance of bank owned HELOC’s fell by 9.5% due to amortization. At current decay rates, HELOCs will disappear as a bank asset class in a few years.

Source: FDIC

In terms of credit performance, the $324 billion in bank owned HELOCs come in line with the first lien 1-4 family mortgages. The small number in actual defaults generates positive results above the principal amount of the loan.

Source: FDIC/WGA LLC

Construction & Development Loans

The $380 billion in C&D loans owned by US banks are relatively conservative compared with the loans that might have been found on the books of a bank a decade ago or in an ABS today. The loan-to-value (LTV) ratios are lower and the amount of cash the owner has in the game is so much higher. As a result, the credit profile of this asset class is relatively pristine, with charge off rates near zero and LGD deeply negative over the past several years.

Source: FDIC/WGA LLC

Despite the impressive credit metrics, C&D lending remains an area of concern for federal bank regulators, especially given the building tsunami of credit defaults affecting owner occupied properties and other such small balance commercial assets. Note the upward spike in LGD in Q2 2020 for C&D loans, a trend we expect will continue as defaults and delinquency accumulate. All of that said, we are still a long way from the loss rates seen on C&D loans in 2009.

Source: FDIC

Residential Construction Loans

In the small ($80 billion) but important portfolio of residential construction loans, the credit metrics are tracking that of the larger construction loan book and with similar volatility in terms of loss rate metrics.

Source: FDIC

Notice that the LGD time series below has been generally negative since 2014, a clear indication of the asset price inflation achieved by the FOMC in real estate assets. The portfolio is also subject to skews, as occurred at the end of 2016 when a large recovery event occurred.

Source: FDIC/WGA LLC

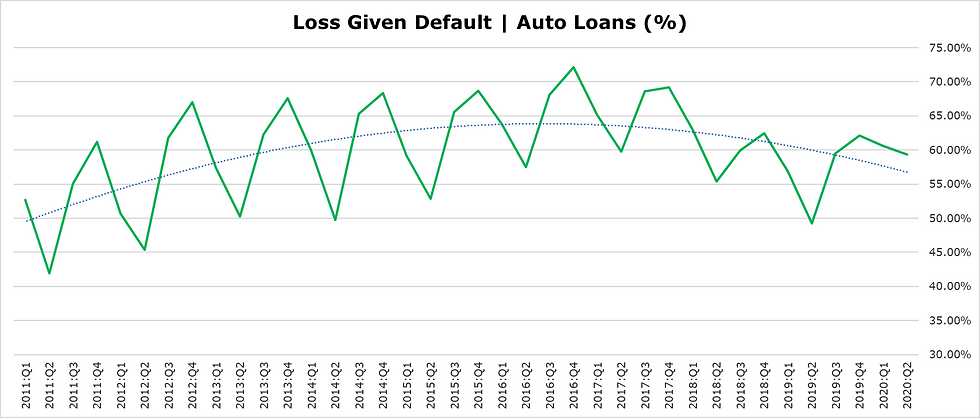

Auto Loans

In the world of auto loans, credit cards and other consumer receivables, the rules of finance change, with prompt and timely resolution of delinquency being the priority and charge-off rates exceeding non-current rates by a substantial amount. The behavior of these portfolios tend to be quite different than other types of bank loans.

Source: FDIC

Source: FDIC/WGA LLC

Non-current auto loans have been trending steadily higher since 2019, but LGD has actually been falling, reflecting strong recovery results due to prices for used cars. That trend seems to have reversed since Q4 2019, however, perhaps reflecting the drop in bank ABS issuance and sales by banks we discussed earlier. Should unemployment continue to rise, as we expect, then credit metrics will deteriorate.

Credit Card Loans

The $800 billion plus in bank owned credit card receivables have behaved reasonably well over the past five years and have not yet displayed any COVID related spikes in defaults or other idiosyncrasies. Net charge off rates have been bumping up against 4% for several years as shown in the chart below.

Source: FDIC

Source: FDIC/WGA LLC

Commercial & Industrial Loans

As we noted at the top of this edition of The IRA Bank Book, the C&I portfolio is generating a lot of noise recently in terms of credit losses, including commercial real estate exposures not captured in the other categories. The numbers are still not yet alarming, but we think that will change in Q3 and beyond. The FDIC reports in the Quarterly Banking Profile:

“The annual increase in total net charge-offs was attributable to the commercial and industrial (C&I) loan portfolio, in which charge-offs increased by $2.4 billion (128.5 percent). The C&I net charge-off rate rose by 31 basis points from a year ago to 0.64 percent, but remains well below the post-crisis high of 2.72 percent reported in fourth quarter 2009.”

Source: FDIC

As we predicted earlier this year, the LGD for bank C&I exposures is headed vertical, with a pretty good bet that loss rates could near or exceed 100%. How can you lose more than 100% of the outstanding loan amount? Because of resolution costs, taxes and other risks that come with owning a property. In many cities, for example, a lender cannot simply abandon a moribund property.

Source: FDIC/WGA LLC

The Final Word

The net effect of the various programs and operations by the Federal Open Market Committee has been to diminish bank income per dollar of assets. The sharp decline in rates is good for mortgage lenders, but the impact on credit overall has been continued tight spreads across the fixed income complex. There is enormous buying pressure from global funds in many asset classes, adding to the competitive pressure on large banks.

The yield on loans and leases by Peer Group 1 was 4.75% at the end of the second quarter of this year, but the big news was the 50% reduction in the cost of deposits. The cost of federal funds and reverse repo has come down by a point over the past year, adding some lift for the banks. The continuing challenge, however, will be finding earning assets and fighting the deflationary tendency of low interest rates. As the chart of net-interest margin at the top of this report suggests, bank operating income is likely to fall in coming quarters.

Source: FDIC/WGA LLC

A relatively flat yield curve and a general dearth of quality credits is making it hard for banks to earn a living. The FOMC’s decision that it would allow inflation to run above its longstanding target in order to make up for periods of “undershooting” caused the curve to steepen last week. But it is unlikely to relieve the tight spreads that prevail in many prime markets.

Bottom line is that we see bank operating earnings in Q3 and Q4 2020 significantly impaired by mounting credit costs on the commercial side of the risk ledger. We do not expect to see a repeat of the market-based performance enjoyed by many banks in Q2 2020. Residential mortgage production is a bright spot on the risk horizon, but this is mostly a non-bank opportunity. While we acknowledge that considerable restructuring activity lies ahead in the commercial portfolio, banks and other advisors are unlikely to prosper greatly or for long when so many of their clients are in distress.

Source: FDIC

The IRA Bank Book (ISBN 978-0-692-09756-4) is published by Whalen Global Advisors LLC and is provided for general informational purposes. By accepting this document, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The IRA Bank Book. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The IRA Bank Book are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The IRA Bank Book represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The IRA Bank Book is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The IRA Bank Book is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The IRA Bank Book. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

Comments