January 12, 2022 | Readers of The Institutional Risk Analyst know that US banks have been trapped in a world of shrinking NIM and asset spreads, and flat volumes, through the years of quantitative easing or QE. Over the same period, investment managers bid up banks stocks to silly levels, both in historical terms and also vs asset and equity returns. The Sell Side host has encouraged this evolution of bank valuations.

Source: Yahoo Finance

Now equity market valuations for financials are churning, just as bank fundamentals threaten to improve from the depths of the hunger-winter of 2020. What will professional investment managers do? Real returns on bank stocks, more than non-financials, are impacted by inflation. The latest iteration of central bank market operations took almost 25bp off the return on earning assets for all US banks. Between Q4 2017 and Q4 2020, ROEA fell from 85bp to just 57p in Q2 2021.

Source: FDIC/WGA LLC

For the year to date 2022, at least, the major financial indices are up after hitting a near-term trough on December 17, 2021.

JPMorgan Chase (JPM), Citigroup Inc. (C) and Wells Fargo & Co. (WFC) will deliver fourth-quarter earnings this Friday. Bank of America Corp. (BAC) and Goldman Sachs (GS) report earnings on January 18 and Morgan Stanley (MS) provides its fourth-quarter update on January 19th. We'll be profiling several of these names in our Premium Service in coming weeks.

The financial media will describe the Q4 2021 results in glowing terms and, of course, always avoid historical comparisons. Just remember that US banks are still running below levels of equity and asset returns of more than two decades ago. Your investment in bank common in 2022 buys less for more moolah than in 2002, thus we accumulate bank preferred when they are cheap – likely real soon. The chart below shows ROA and ROE for all federally insured depositories as of the end of Q3 2022.

Source: FDIC/WGA LLC

The failure of the Federal Open Market Committee to manage inflation is as nothing compared to the silence regarding the cost/benefit of QE. The utter incapacity of monetary policy to grow demand for credit on $22 trillion in bank assets has inspired zero commentary from the Sanhedrin of American economic policy. Meanwhile, the cost of QE continues to mount. Senator Pat Toomey (R-PA) summarized the situation in the confirmation hearing for Federal Reserve Board Chairman Jerome Powell:

“None of the Fed’s pandemic actions came without a cost. This negative-real interest rate environment continues to distort markets, risk asset bubbles, and punish savers. And the Fed has dramatically expanded its balance sheet with trillions in government bonds, effectively monetizing a lot of debt, facilitating profligate government spending.”

The losers with QE are all savers, from banks to retirees. In the past five years of extraordinary policy, including during the aggressive period of policy response to COVID, bank lending has been flat and, indeed, significant portfolios across the industry like credit cards and C&I loans are shrinking.

Lending from the nonbank sector, much of it processed and closed by partners such as Cross River Bank, has exploded, driven by more efficient point of sale tools. As we discuss below, the legacy of QE may well be an equally large bubble in credit losses generated by nonbanks and sold to banks and end investors.

The chart below shows bank lending vs deposits through Q3 2021, a key relationship for investors to understand now that QE is ending, perhaps suddenly. As deposits start to fall, will bank lending increase? The lending performance of US banks going back to 2008 suggests the answer is no.

Source: FDIC

With talk now shifting to ending QE and raising interest rates, the prospect of another liquidity crisis looms. Like taking heroin or opium, the immediate effect of QE is pleasant enough, but the monetary sippy cup requires a constant refill to maintain that particular sense of market euphoria. The narcotic effect of QE is clearly visible in unproductive areas such as crypto and meme stocks. Brendan Greeley notes with his usual insight in the FT that bitcoin is "an asset that has value, but no purpose."

With the end of QE, however, the agreeable feeling leaves and is replaced instead by dread, namely a tightening or constriction of liquidity. For every bond that matures or prepayment that is received in the system open market account (SOMA), the Treasury must immediately refund that bond. When the Treasury repays the Fed and issues a new piece of debt, a bank deposit disappears. If the Fed reduces or eliminates QE, then bank deposits start to shrink -- fast. But we've seen this movie before.

Former Fed Chairman Ben Bernanke is said to have observed at the start of massive asset purchases a decade ago, once you start QE you cannot stop. In December 2018 and September 2019, the Fed’s attempts to raise rates and end QE simultaneously ended in disaster. Part of the problem was that liquidity was ebbing, but the other side of the trade involved an increase in net supply of Treasury paper and MBS on a dealer community unable to shoulder the load.

With the rapid, almost daily evolution of FOMC policy, we may well enter February with the Fed intent upon ending net purchases of securities and even starting to taper. Sometime after June 2022, we may arrive at a replay of September 2019.

Earnings Setup | JPM, USB, BAC, C, WFC

As we go into earnings on Friday, the outlook is for strong results on the transactional side of the house at JPM and signs of lift in terms of the banking business, which is now less than half of the bank’s total assets. CEO Jaime Dimon has guided the Street to net interest income of $51 billion for Q4 2021, but this is still below the bank’s reported performance going back five years.

Source: FFIEC, JPM

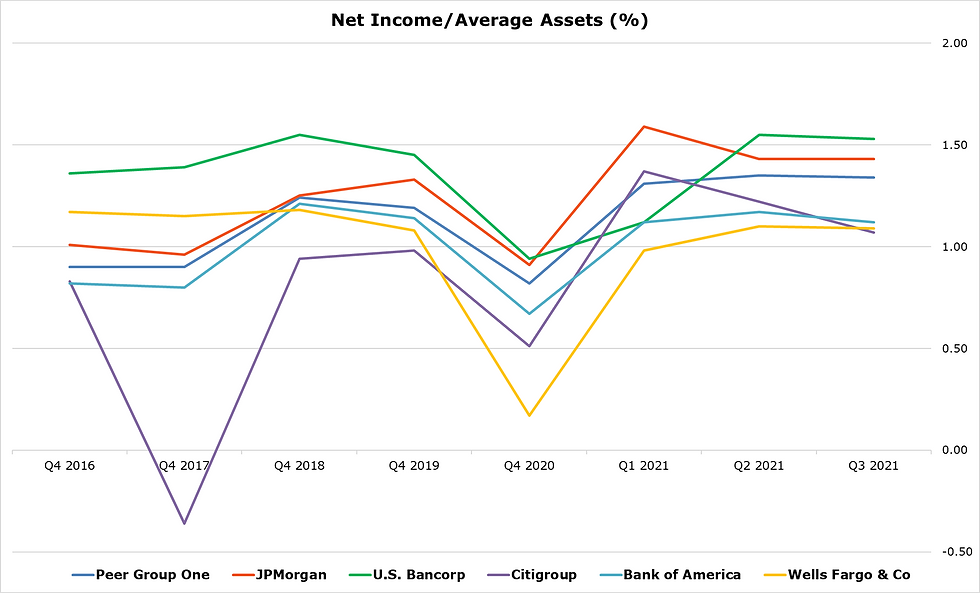

In order to understand the deleterious impact of QE on banks generally, let’s now compare JPM to the other banks in the top five depositories based on asset returns. Again, the negative impact of QE on bank asset and equity returns is apparent, in part due to the fact that QE has swollen bank balance sheets with a lot of sterile deposits that have no utility in terms of encouraging credit expansion or supporting bank income.

All of these names should see improvement in asset and equity returns in Q4 2021. Notice in the chart below that USB has been the most stable performer of the top-five bank group, followed by JPM and Peer Group 1. Citi, BAC and WFC are all performing below the average for Peer Group 1. Notice that the Bank of Brian and Wells are competing for last place.

Source: FFIEC

The good news is that we expect the change in Fed monetary policy to be a net positive for bank results, but this does not mean that investors will react rationally. Just as the fact of QE compelled a lot of investment managers to buy bank stocks as the earnings fundamentals for financials deteriorated, today we may see just the opposite behavior with managers selling bank stocks out of fear of an eventual recession. At the moment, however, bank stocks are on the rebound YTD.

As we never tire of reminding our readers, bank earnings are driven by spreads rather than market rates. When you hear a talking head on TV saying that the increased yield on the 10-year Treasury note will help bank earnings, that is your signal to change the channel to ESPN. The chart below shows gross loan yields for the top-five banks and Peer Group 1.

Source: FFIEC

Readers will notice that the average spread for the 140+ banks in Peer Group 1 beats out all of the top-five banks other than subprime lender Citi, an illustration of the fact that smaller banks have better pricing power for loans. Large banks suffer a disproportionate negative impact from QE. Perhaps Senator Elizabeth Warren (D-MA) can sponsor a new agency in Washington to defend money center banks from the ill-considered policy gyrations of the FOMC.

One area that needs watching during Q4 earnings is stock repurchases, a popular way for under-leveraged banks to return capital to shareholders. Angry Jacobins such as Senator Warren have attacked the largest banks for employing share repurchases. Indeed, JPM’s Dimon has already indicated that he intends to slow or end share repurchases so as to avoid skewing the bank’s capital structure.

Source: FFIEC

Bottom line is that we expect Q4 2021 bank earnings to show the slow emergence of US banks from the winter of QE, which should see run rate revenue and net income revert back to year-end 2019 levels in short order. Over the balance of 2022, however, as state and federal loan forbearance moratoria due to COVID end, look for the cost of credit to also return to pre-COVID, pre-QE levels and higher.

After a period of credit expansion, mostly outside of the banking sector, credit inevitably becomes an issue. As the weaker corporate and consumer borrowers are no longer supported by artificially low interest rates c/o QE, credit expenses will rise and loss given default, currently negative for many loan types, will swing back into positive territory. The chart below shows the sharp drop in post-default loss on all $11 trillion in US bank loans through Q3 2021.

Source: FDIC/WGA LLC

In the short-run rising interest rates and spreads will help bank earnings, but rising credit costs in areas such as consumer exposures in mortgages and credit cards, and multifamily real estate in commercial loans, may start to require a larger share of NII, depressing bank earnings. In October 2017 (“Bank Earnings: QE Means "Lower for Longer’”) we wrote:

“An end to QE also implies a significant increase in credit losses for US banks, an eventuality that will not be a problem given robust reserve and capital levels. But the wild card for global financials is whether the suppression of credit spreads by the Fed and other central banks has caused the formation of another hot spot of risk that is currently hidden from investor scrutiny.”

Where is the next credit hot spot created by QE? That is the question for 2022.

Disclosures: L: NLY, CVX, NVDA, WMB, BACPRA, USBPRM, WFCPRZ, WFCPRQ, CPRN, WPLCF, NOVC

The Institutional Risk Analyst is published by Whalen Global Advisors LLC and is provided for general informational purposes. By making use of The Institutional Risk Analyst web site and content, the recipient thereof acknowledges and agrees to our copyright and the matters set forth below in this disclaimer. Whalen Global Advisors LLC makes no representation or warranty (express or implied) regarding the adequacy, accuracy or completeness of any information in The Institutional Risk Analyst. Information contained herein is obtained from public and private sources deemed reliable. Any analysis or statements contained in The Institutional Risk Analyst are preliminary and are not intended to be complete, and such information is qualified in its entirety. Any opinions or estimates contained in The Institutional Risk Analyst represent the judgment of Whalen Global Advisors LLC at this time, and is subject to change without notice. The Institutional Risk Analyst is not an offer to sell, or a solicitation of an offer to buy, any securities or instruments named or described herein. The Institutional Risk Analyst is not intended to provide, and must not be relied on for, accounting, legal, regulatory, tax, business, financial or related advice or investment recommendations. Whalen Global Advisors LLC is not acting as fiduciary or advisor with respect to the information contained herein. You must consult with your own advisors as to the legal, regulatory, tax, business, financial, investment and other aspects of the subjects addressed in The Institutional Risk Analyst. Interested parties are advised to contact Whalen Global Advisors LLC for more information.

Comments